With Astro Acquisition Looming, Horizon Says Investors Still Bullish On eVTOL Air Taxis

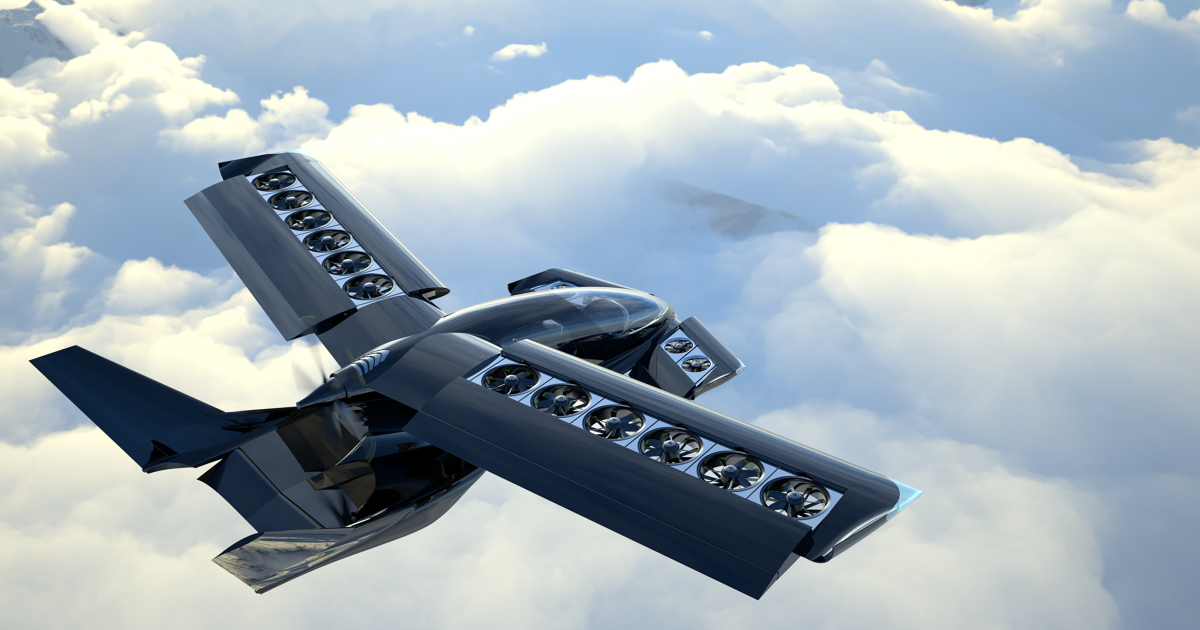

Astro says it plans to acquire Horizon Aircraft as it seeks a Nasdaq listing to support plans for a trio of eVTOL designs, the Cavorite X5, the Alta and the Elroy.